Board of County Commissioner Meetings are the first and third Tuesdays of the Month, 9:00 AM, at the County Auditorium, 500 San Sebastian View.

Link to the full agenda is here: BOCC Agenda 9-5-23

Picking up after the lunch recess, there was a long afternoon ahead conlucing with the special meeting to cover the 2024 Millage rates and budget.

Agenda Items 5 and 6 also impacts the Longleaf Pine Parkway/County Road 210 area. The Comprehensive Plan Amendment and PUD for the Mensforth Family Community Commercial are to change the zoning for approximately 4.25 acres of land from Rural/Silviculture to Community Commercial. The PUD will include about 25,000 sq. ft. of commercial activities. This was approved.

Agenda Item 9 is of interest to those who follow our Bald Eagle population.

Special Magistrate Recommendation in Day Late Enterprises, Inc. v. St. Johns County

“On June 9, 2022, the Board of County Commissioners (“Board”) rendered an order denying a nonzoning variance application by Day Late Enterprises, Inc. (“Day Late”) for a proposed alternative bald eagle management plan for certain property along State Road 16, the majority of which is undeveloped, but a portion of which is within the Grand Oaks PUD. Day Late filed a request for relief from the denial under the Florida Land Use and Environmental Dispute Resolution Act, section 70.51, Florida Statutes (“FLUEDRA”), which provides means to potentially resolve disputes pre-suit through a special magistrate mediation and hearing process. After the conclusion of the hearing, the special magistrate is required to issue a written recommendation, which the governmental entity must accept, modify, or reject within 45 days after receipt. Failure to act within 45 days is deemed a rejection. Thirty days after any rejection, the government entity must issue a written decision of the uses available to the subject property. The special magistrate in this matter issued a written recommendation on August 8, 2023, which is attached here for the Board’s review and consideration for possible action.”

Details here: Agenda Item 9

The recommendation to the Commissioners was that they take no action. The county code is stricter than the Federal guidelines and that is allowed. by taking no action, the Commissioners are standing by their previous denial.

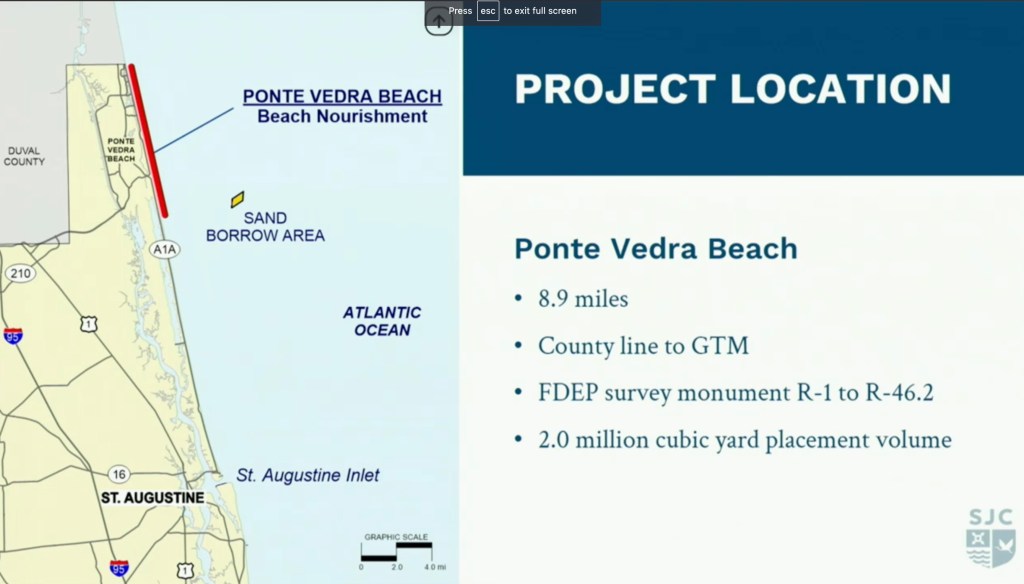

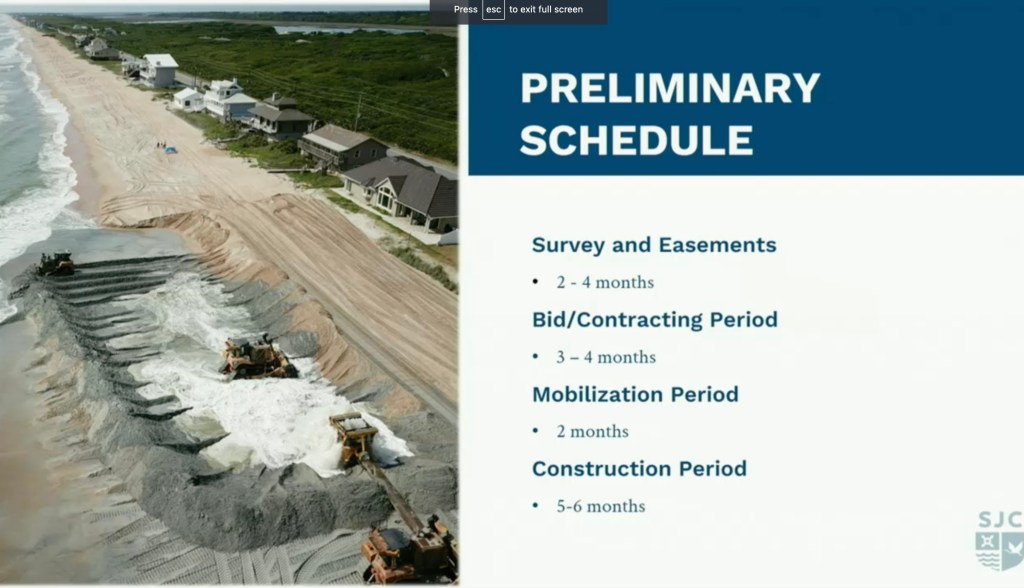

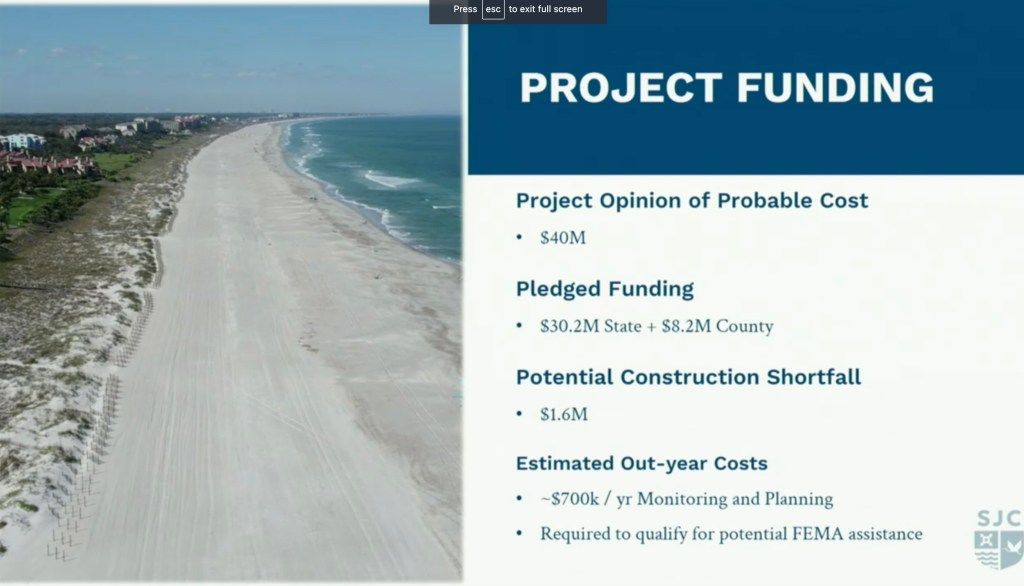

Agenda Item 10 – Discussion and request for direction regarding funding options in connection with the Ponte Vedra Beach Restoration project

This project covers from the St. Johns County/Duval County Line down to Vilano Beach.

This was a lengthy discussion – you can watch the full discussion at this link: Ponte Vedra Beach Restoration Project

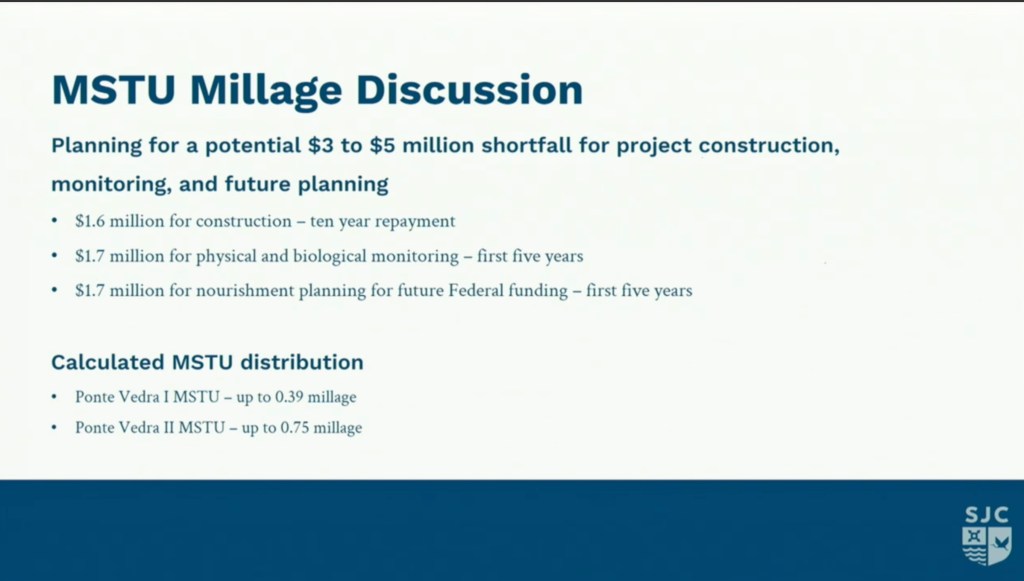

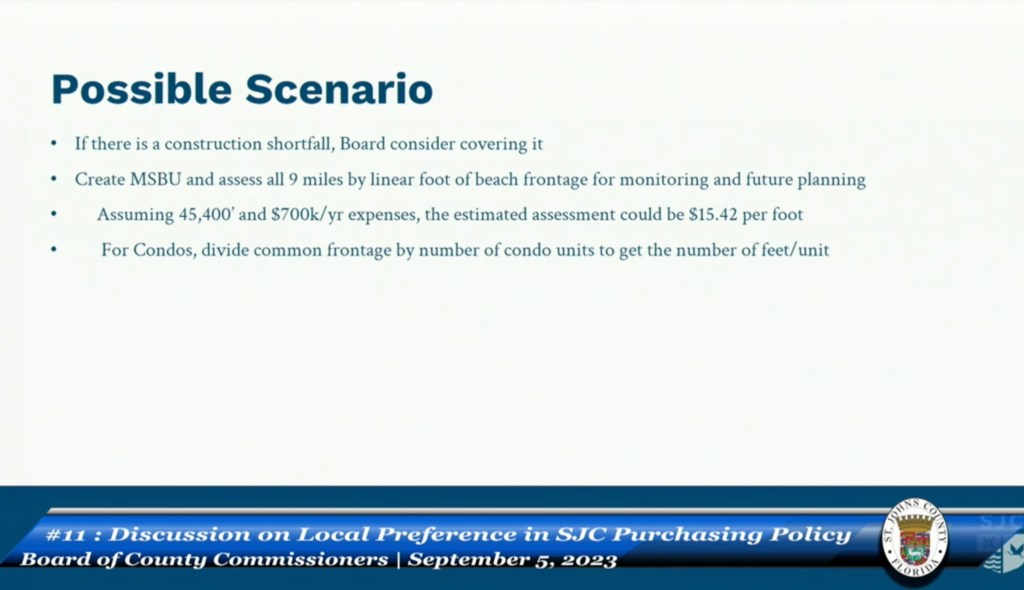

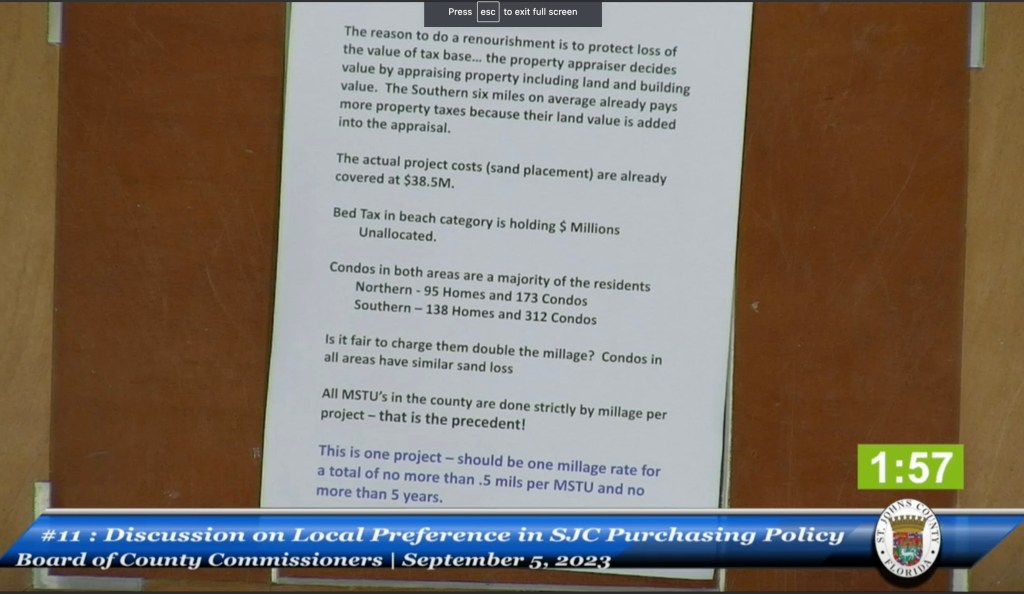

Commissioner Joseph raised concerns about the divisive nature of the separate MSTUs pitting neighbor against neighbor. She had a counter proposal with creating 1 taxing district and for the county to carry the cost of the construction.

Commissioner Dean spoke about his 5 years of working on this project and disagreed with Commissioner Joseph on how to cover the costs. He indicated that 80% of the cost is related to 6 miles of beach and he supports the staff analysis and breakdown of the millage between the 2 MSTUs.

There was further discussion between Commissioners Dean and Joseph about the discussions each have had with residents in the beaches area.

Public Comment included support for creating 1 MSTU with emphasis that this is for one Ponte Vedra Beach and one community.

During Commissioner discussion, there was clarification that the millage could be assessed only if there is a shortfall in funding. They do not yet have the final budget for the project.

Commissioner Dean proposed a motion on the 2 MSTUs. Commissioner Joseph raised a “point of order” that Commissioner Dean made the motion and this is in her District. Attorney Migut explained that it is the custom of the Board to defer to the Commissioner of the District but not a point of order.

Commissioner Joseph countered that this should be a single MSTU.

Commissioner Dean’s 3 part motion passed 4:1 with Commissioner Joseph being the no vote.

Interim County Administrator Joy Andrews clarified for the Board that there is no vote here on millage to be assessed, only on the split between the two MSTUs and that any proposed millage would be part of the budget discussions in 2024, for the 2024 assessments.

Commissioner Joseph made a motion to levy the MSTUs at one rate rather than two. The motion died for lack of a second

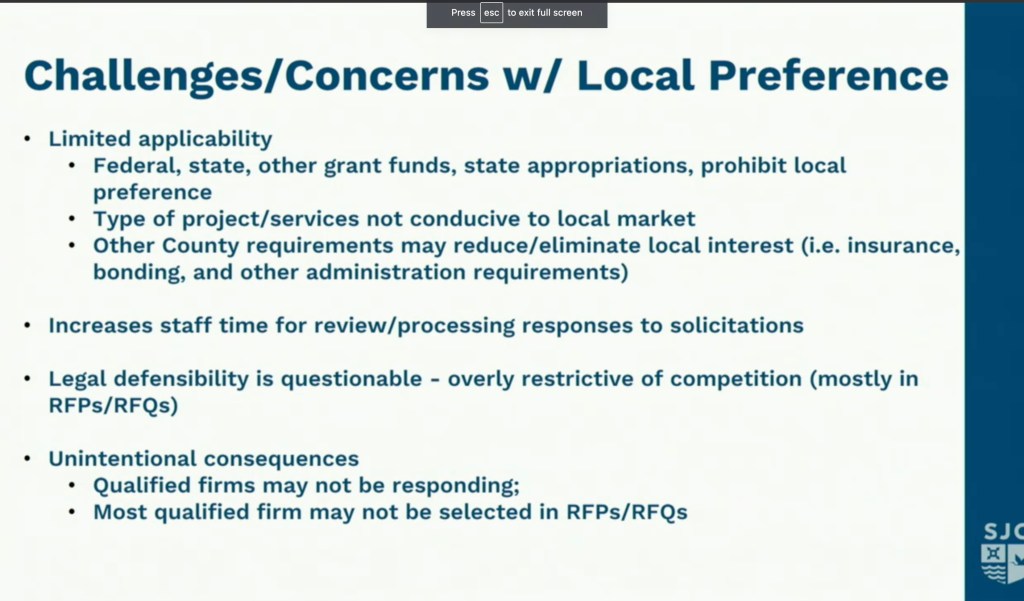

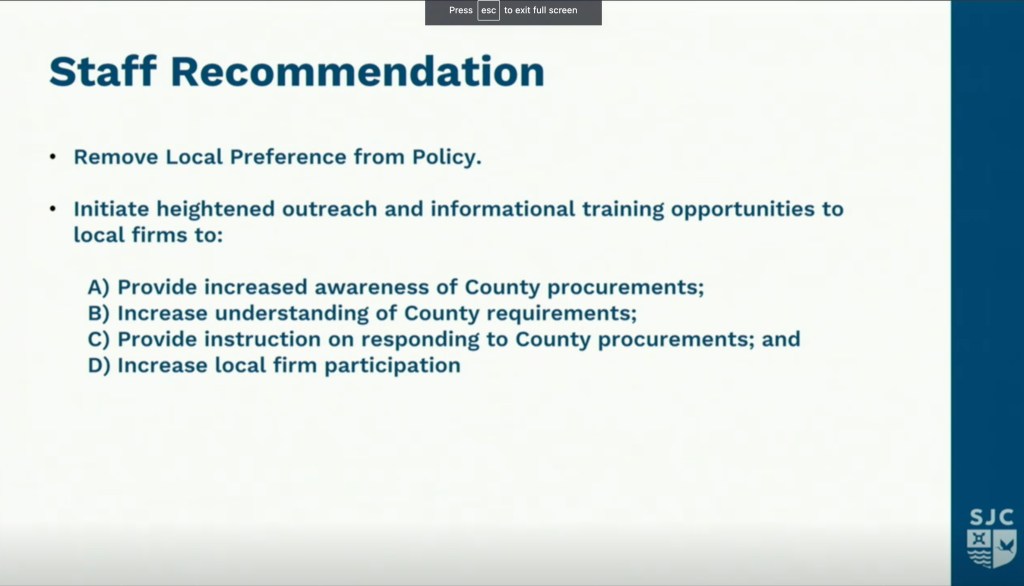

Regular Agenda Item 10 – Discussion on Local Preference in SJC Purchasing Policy

This item was a discussion to determine whether or not to remove the application of Local Preference as included in the SJC Purchasing Policy.

Presentation materials can be found here: Local Preference in Purchasing

There was no motion made regarding this item. Commissioner Dean stated he is in favor of eliminating the local preference policy. Others mentioned the favorability of keeping purchasing dollars local and agreed there was further discussion needed. There was an ask for the Purchasing department to discuss this with the Chamber of Commerce and come back with recommendations at a future meeting.

Regular Agenda Item 11 – Project Krew Updated Economic Incentive Request

This is an updated request from a confidential business for economic incentives related to locating a new business in St. Johns County.

Residents spoke out against the incentives because the business is unknown to the public. It became clear in the Commissioner’s comments that they do know the project but are keeping it confidential and they are in favor of the project because of the jobs and revenue it will bring to the county.

At 5:01 was the Public Hearing on the Adoption of Tentative Millage Rates & Budget for FY 2024.

Certainly this has been a hot topic of discussion across the county with the mailing of the TRIM notices in August!

This is the first public hearing with the final public hearing recommendation date being September 19. This was the first opportunity for the public to comment and ask questions prior to the adoption of the final budget for FY 2024.

Presentation and millage rates are at this link: Trim Notice Presentation

You can watch the full presentation at this link: Budget Presentation

“In accordance with sections 129.03 and 200.065 of the Florida Statutes, the Board of County Commissioners (BCC) is required to hold public hearings to adopt its millage rates and budget for the next Fiscal Year (FY). Such hearings must be held after 5:00 PM if scheduled on a day other than Saturday. In the recently mailed Notices of Proposed Property Taxes (TRIM) by the County’s Property Appraiser, the date and time noticed for the required hearings is September 5, 2023, at 5:01 P.M. The Florida Statutes further prescribe the specific order for consideration of substantive issues to be discussed during the required public hearings. The first substantive issue of discussion must be the percentage increase in the County’s aggregate millage rate over the rolled-back rate necessary to fund the budget. The rolled-back rate is defined as the aggregate millage rate that would generate the same level of prior year tax revenues less certain defined allowances (such as new construction). During such discussion, the general public shall be allowed to speak and ask questions prior to the adoption of any measures by the BCC. The BCC shall adopt by resolution its tentative millage rates prior to adopting its tentative budget for FY 2024. Additionally, the BCC is required to establish a date, time, and place to conduct public hearings on the final millage and budget adoption for FY 2024. It is recommended that the BCC establish September 19, 2023, at 5:01 PM, in the County Auditorium to conduct such hearings. A copy of the FY 2024 Tentative Budget Workbook, including detail per line item, may be found on the County’s webpage at http://www.sjcfl.us/OMB/”

Public Comment

During Public Comment there were a couple of trends, one was concerns from people who’s home value has increased but their income has not. Taxes on the increased value of their home is not something their budgets can easily handle. There are people who own rental properties and try to maintain a lower rent for the people that live and work in this county but with the increase in property taxes AND insurance rates, it is difficult for them to continue to keep their rents low.

There was also comment that there are areas in the budget that could be reduced.

The Commissioners voted 5:0 to adopt the millage rates and budget for 2024.

If you are finding value in these updates, please subscribe to my blog so you get notifications when I publish an update. Feel free to share with others who may find value in the content.